Jewelry Insurance FAQs

- What paperwork do I need to insure my jewelry?

- Why is a detailed jewelry appraisal important?

- How might I be overpaying premiums?

- Won’t a claim settlement be equal to the valuation amount listed on my appraisal? Isn’t that what I’m paying premiums for?

- How do I know whether the valuation given on my appraisal is accurate?

- I bought my jewelry on the Web. Those businesses have little overhead, so their prices are a lot lower than in stores, right?

- Where can I get a reliable appraisal that has all the necessary information?

- What is a GG?

- What is an FGA+?

- What is a CIA?

- How can I find a CIA in my area?

- What about premium discounts?

- What is JISO, and what are the JISO forms?

- Why did my agent recommend the Jewelry Sales Receipt for Insurance Purposes (JISO 805) or the Jewelry Document for Insurance Purposes (JISO 806) when I’ve already bought the jewelry and have an appraisal?

- I’m not sure what some of the terms on these forms mean. Where can I get explanations?

What paperwork do I need to insure my jewelry?

Bring the appraisal, a photo of the jewelry in jpg format, the sales receipt for a recent purchase, and any other documents you may have, such as lab reports, certificates and warrantees. If you don't have a photo, your JIBNA agent can help you obtain one.

In the case of older jewelry or gifts that do not have accompanying paperwork, we recommend getting a written appraisal from a qualified gemologist appraiser, such as a GG, FGA+ or Certified Insurance Appraiser (CIA). (See below for more details.)

Why is a detailed jewelry appraisal important?

A detailed appraisal specifies all of the jewelry’s characteristics, including gem and metal grades, characteristics and measurements. It is a precise description of the jewelry being insured.

Should you ever need to file a claim, your settlement will be based on the appraisal’s description. This means an accurate and detailed appraisal is your assurance of a fair settlement, reflecting the true value of your jewelry.

How might I be overpaying premiums?

Jewelry insurance premiums are based on the valuation given on the appraisal.

If you should ever need to file a claim, your settlement will be based on the actual cash value of the jewelry at time of loss. If the appraisal valuation was artificially high (perhaps because the appraiser was untrained, or because the seller—who claimed to be giving you 50% off the “regular retail price”—listed a much higher value on the appraisal), that just means you will pay higher premiums. It does not make the claim settlement higher.

On a detailed appraisal, the description of the jewelry substantiates the valuation. It’s in your interest to have an appraisal with an accurate valuation and a detailed description of the jewelry.

Won’t a claim settlement be equal to the valuation amount listed on my appraisal? Isn’t that what I’m paying premiums for?

You are paying premiums to cover the replacement/repair cost of your jewelry if it is damaged or lost. Your premiums are based on the valuation of the jewelry. If the jewelry is new, the valuation should normally be pretty close to the purchase price.

A settlement is based on the value of the jewelry at the time of loss, less depreciation if any. Many factors can affect the value of jewelry over time, such as fluctuations in the market price of gold, silver, platinum and gems. Over the years, the value of your jewelry may go up or down. If gems and precious metals cost less than when you purchased the jewelry, the jewelry’s value may be less. On the other hand, if gems and metals have gone up in price, your appraisal's valuation may fall short of the current replacement price of such jewelry.

For example, gold prices have varied quite a bit over this 10-year period:

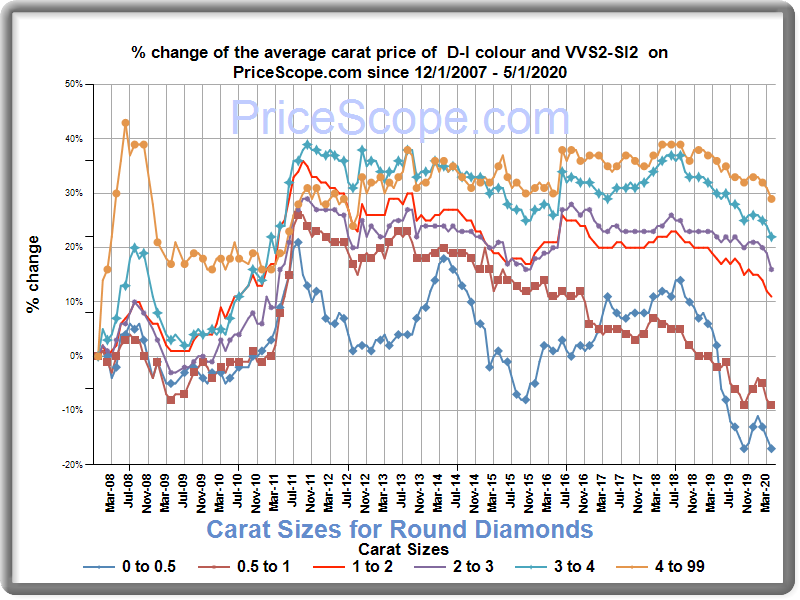

Similarly, diamond prices are subject to change. This graph gives only a sense of the fluctuations, as pricing depends on the 4 Cs of the diamond in question, and availability can play a big part in pricing.

In view of such market fluctuations, your best protection is to keep the jewelry appraisal current by getting a new valuation every few years.

How do I know whether the valuation given on my appraisal is accurate?

For new jewelry, the valuation should be equal to the jewelry’s regular selling price. Thus, a serious indication that an appraisal’s valuation is NOT accurate is when it is significantly higher than the purchase price.

All retailers are in business to make money, and selling far below the store’s “regular retail price” wouldn’t keep the store in business for long. If the bargain you got seemed “too good to be true,” the valuation the jeweler gave you is probably not accurate. If the jewelry came with a lab report or other document saying the jewelry is worth much more than you paid, be aware that not all gem grading labs are reliable. The best way to resolve a questionable valuation is to get the piece appraised by an independent jeweler/appraiser who is a a qualified gemologist (GG, FGA+, or equivalent) with additional insurance appraisal training, such as a CIA (Certified Insurance Appraiser™).

I bought my jewelry on the Web. Those businesses have little overhead, so their prices are a lot lower than in stores, right?

Don’t count on it. Internet stores, shopping channels and the like take advantage of the fact that you can’t see and handle the jewelry. They hardly ever give enough detailed information to allow you to comparison shop. Often they are selling at low prices because the goods are low quality. If you’ve bought jewelry on TV or the Internet, immediately have it reappraised to be sure it is worth the price you paid.

Where can I get a reliable appraisal that has all the necessary information?

We recommend getting an appraisal from a jeweler/appraiser who is a Graduate Gemologist (GG), preferably one who has additional training as a Certified Insurance Appraiser™ (CIA).

What is a GG?

Not all jewelry sellers or jewelry appraisers are trained in gemology. A Graduate Gemologist has taken a series of courses (and exams) from the respected Gemological Institute of America. He or she is trained in grading diamonds and colored gems, and in recognizing gem treatments. We highly recommend seeking out a Graduate Gemologist to write your appraisal. Jeweler/appraisers who have this training will usually include the letters GG after their signature and on their business cards. You can always ask the jeweler whether he/she is a Graduate Gemologist.

What is an FGA+?

Not all jewelry sellers or jewelry appraisers are trained in gemology. The FGA+ credential (including the + sign) indicates that the appraiser is a member of the respected Fellowship of the Gemmological Association of Great Britain, having followed a course of study that includes both gemology in general and diamonds specifically. Gemologists with this training will usually indicate it below their signature. You can always ask the jeweler/appraiser about their credentials.

What is a CIA?

A Certified Insurance Appraiser™ is a GG or FGA+ who has additional training in writiing jewelry appraisals to insurance industry standards. CIAs write detailed appraisals because they understand how your appraisal is used by the insurer. CIAs are qualified to write appraisals on JISO 78/79 forms.

How can I find a CIA in my area?

Follow this link to find a Certified Insurance Appraiser near you.

What about premium discounts?

JISO 78 or 79 Jewelry Appraisal, completed by a qualified gemologist, such as a CIA, is the gold standard for accurate and detailed insurance appraisals.

If there is no CIA in your locale, you can go back to the jeweler who sold you the piece and ask them to complete the Jewelry Sales Receipt for Insurance Purposes (JISO 805). Or, you can go to any jeweler and have him fill out the Jewelry Document for Insurance Purposes (JISO 806).

JIBNA offers premium discounts to clients who submit properly filled out jewelry appraisals on any of these JISO forms. Ask your agent for details.

See below for further information and for links that allow you to print out the JISO forms. Take the appropriate form along when you go for an appraisal.

What is JISO, and what are the JISO forms?

The Jewelry Insurance Standards Organization maintains standards for facilitating jewelry insurance and protecting consumers. JISO encourages insurers and consumers to use its appraisal forms because they call for precise jewelry descriptions, allowing the jewelry to be properly insured.

Follow the links to view or print out any of the forms.

- JISO 78 Jewelry Insurance Appraisal – Single Item

This is a detailed appraisal with reliable information and warrantees that protect the consumer. It guarantees that the appraiser inspected the jewelry in a gem lab (rather than relying on the word of the gem supplier), describes the jewelry in precise gemological language, and uses internationally recognized grading scales. This form must be completed by a qualified gemologist (GG, FGA+, or equivalent), who has additional insurance appraisal training, such as a CIA (Certified Insurance Appraiser™). - JISO 79 Jewelry Insurance Appraisal [for multiple items]

Similar to JISO 78, this form is used for multiple items being appraised together. It must be completed by a qualified gemologist (GG, FGA+, or equivalent), who has additional insurance appraisal training, such as a CIA (Certified Insurance Appraiser™). - JISO 806 Jewelry Document for Insurance Purposes

Any trained jeweler/appraiser can use this form. It provides essential descriptive information needed to insure your jewelry. We recommend the appraiser be a GG or FGA+, having the expertise to examine the jewelry and determine its qualities. - JISO 805 Jewelry Sales Receipt for Insurance Purposes

This form can be completed by the retailer who sells the jewelry. Properly filled out, it gives sufficient detail to properly insure your jewelry, and it specifies that the valuation given is the price paid for the jewelry in that store. (It’s a good idea to print out this form and take it along when you shop for jewelry.) - JISO 18 Jewelry Appraisal & Claim Evaluation [filled out by insurer]

Clients often submit to insurers appraisals that are written in a narrative form, as a paragraph or list of attributes. Insurers use JISO 18 to “unpack” such an appraisal, putting the information in a standardized, easy-to-read format. You may have received a form like this from your insurer, highlighting crucial information that was left out of your appraisal. This format helps both insurers and consumers see whether an appraisal is sufficiently detailed.

Why did my agent recommend the Jewelry Sales Receipt for Insurance Purposes (JISO 805) or the Jewelry Document for Insurance Purposes (JISO 806) when I’ve already bought the jewelry and have an appraisal?

If you’ve submitted an appraisal that does not sufficiently describe your jewelry, it is to your advantage to obtain more complete information about the jewelry by taking the appropriate JISO form to your jeweler/appraiser. The JISO forms prompt the appraiser for the necessary details. Either take the JISO 805 Sales Receipt to the jeweler who sold you the piece, or take the JISO 806 to any trained appraiser, preferably a GG or FGA+. Submitting either of these documents to JIBNA qualifies you for premium discounts.

I’m not sure what some of the terms on these forms mean. Where can I get explanations?

A good place to look is the JCRS GemQuote® Checklist, which has links to explanations of many jewelry terms. The Checklist is part of the JCRS Consumer Site, which has a wealth of useful information for jewelry shoppers and owners.